Best Of The Best Info About How To Apply For A Reverse Mortgage

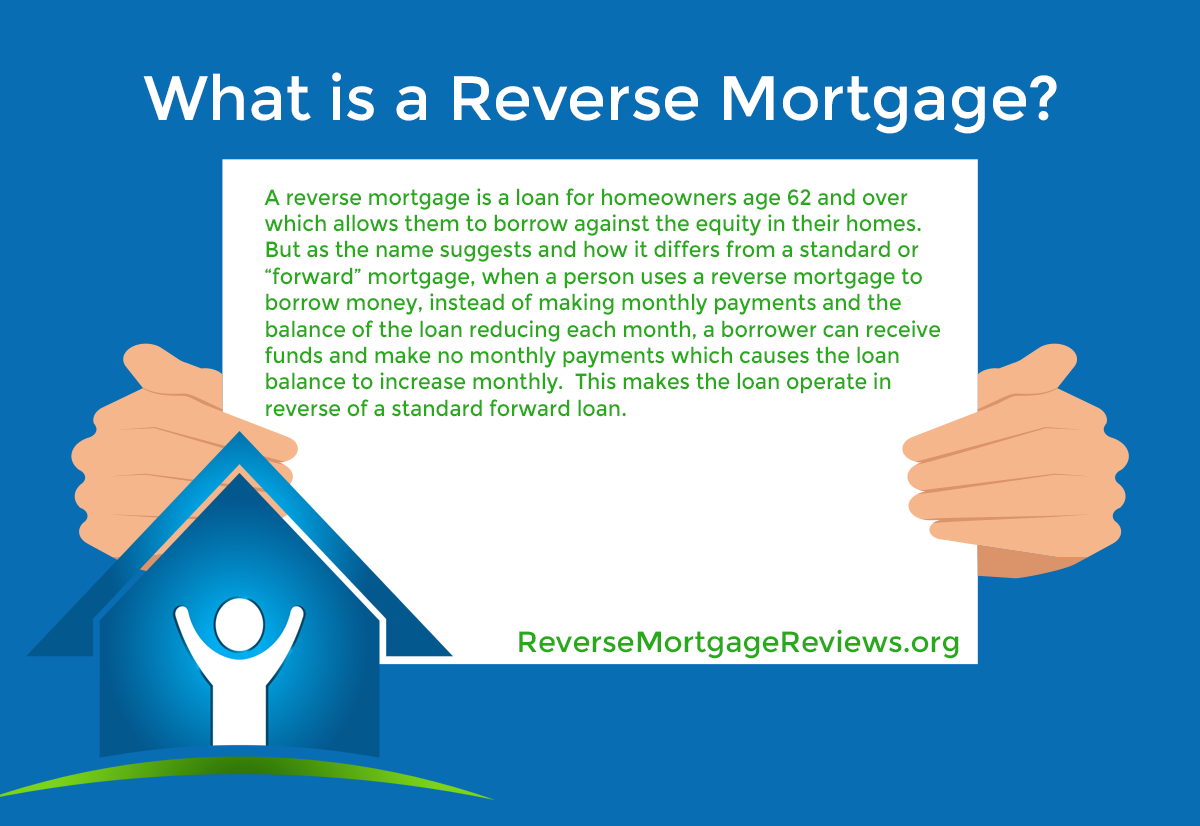

Reverse mortgages allow seniors age 62 and older to borrow against the equity of their primary home, with the lender making the payments instead of the borrower.

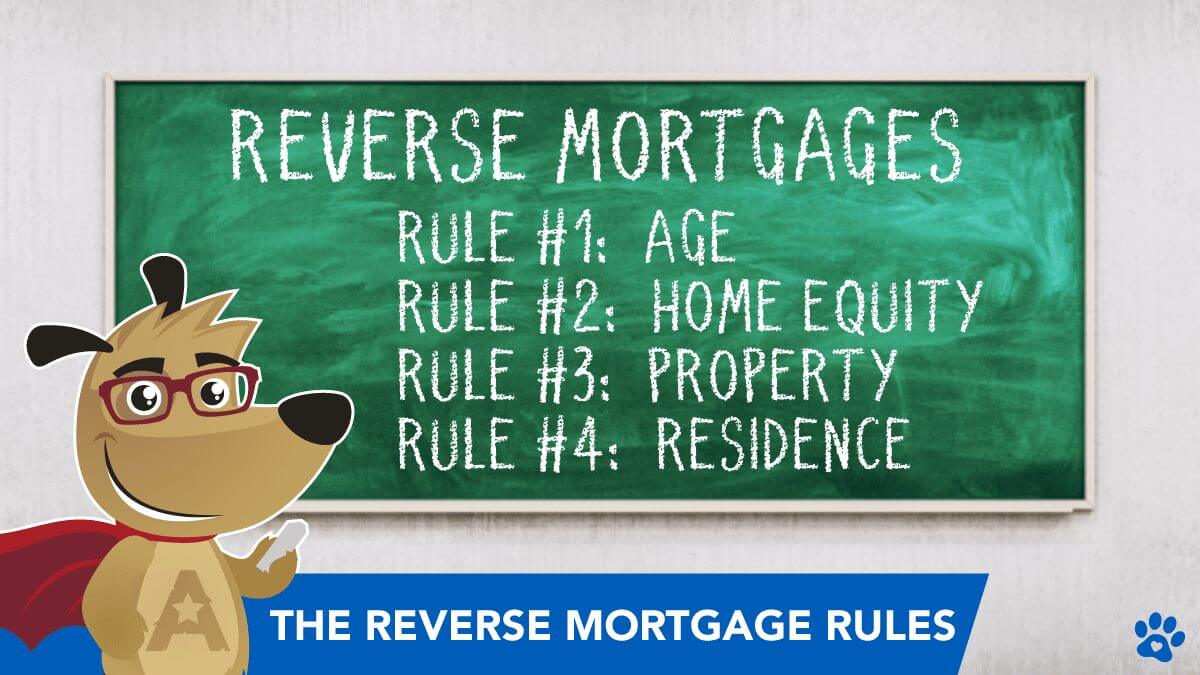

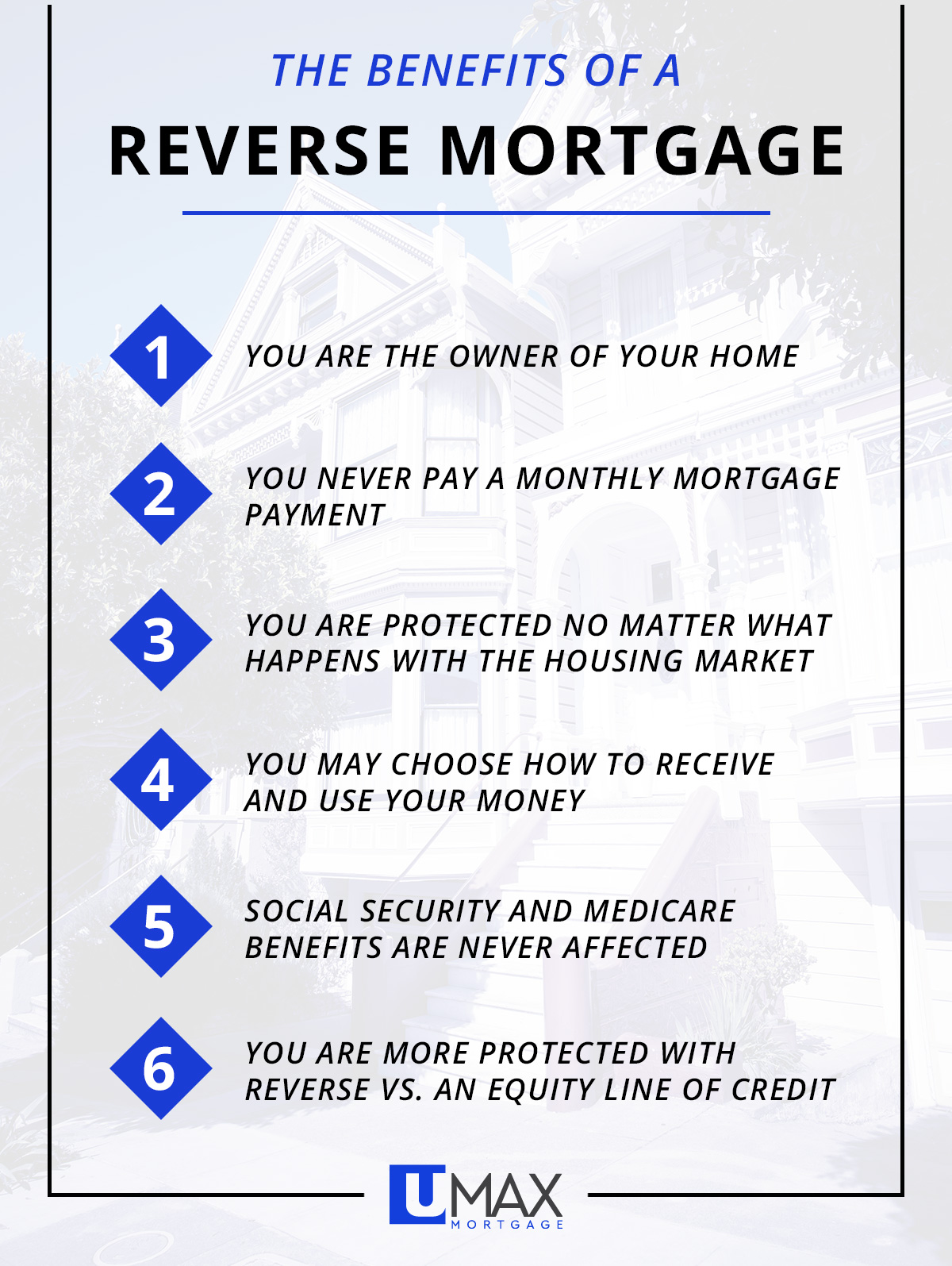

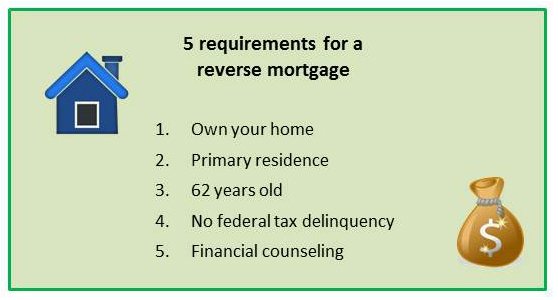

How to apply for a reverse mortgage. Tap into the power of your home's equity and reduce financial stress with a reverse mortgage. Try our free calculator to receive a general estimate if you are eligible. Requirements for applying for a reverse mortgage if you’re considering applying for a reverse mortgage, there are some basic requirements you need to meet.

The application legally authorizes the lender to begin the application process but the lender cannot incur any costs on your behalf until step 2 (counseling) is completed. Receive a commitment step 4: Applying for a reverse mortgage is normally a quick and easy task;

Do i have to use an estate planning service or pay to find a reverse mortgage? You can apply for the reverse mortgage 90 days before your 62nd birthday on the hud program but you cannot close the loan until then. Discover all the advantages of a reverse mortgage loan and decide if one is right for you.

Table of contents step 1 (optional): A lender cannot begin processing a reverse mortgage loan application until. Ad if you’re 62 or older, a reverse mortgage loan may be right for you.

Get a free information kit. A reverse mortgage allows you to borrow money using the equity in your home as security. How to apply for a reverse mortgage?

The application is not binding and can be canceled at any point during the process. Get real answers to hecm loan questions. Reverse mortgages don’t have income or credit score requirements.

/dotdash-reverse-mortgage-or-home-equity-loan-v3-eb9ddc756b1d47adba885c60bf2f854c.jpg)