Looking Good Info About How To Recover Credit After Bankruptcy

These can be widely accessible to consumers with bad credit, and you should.

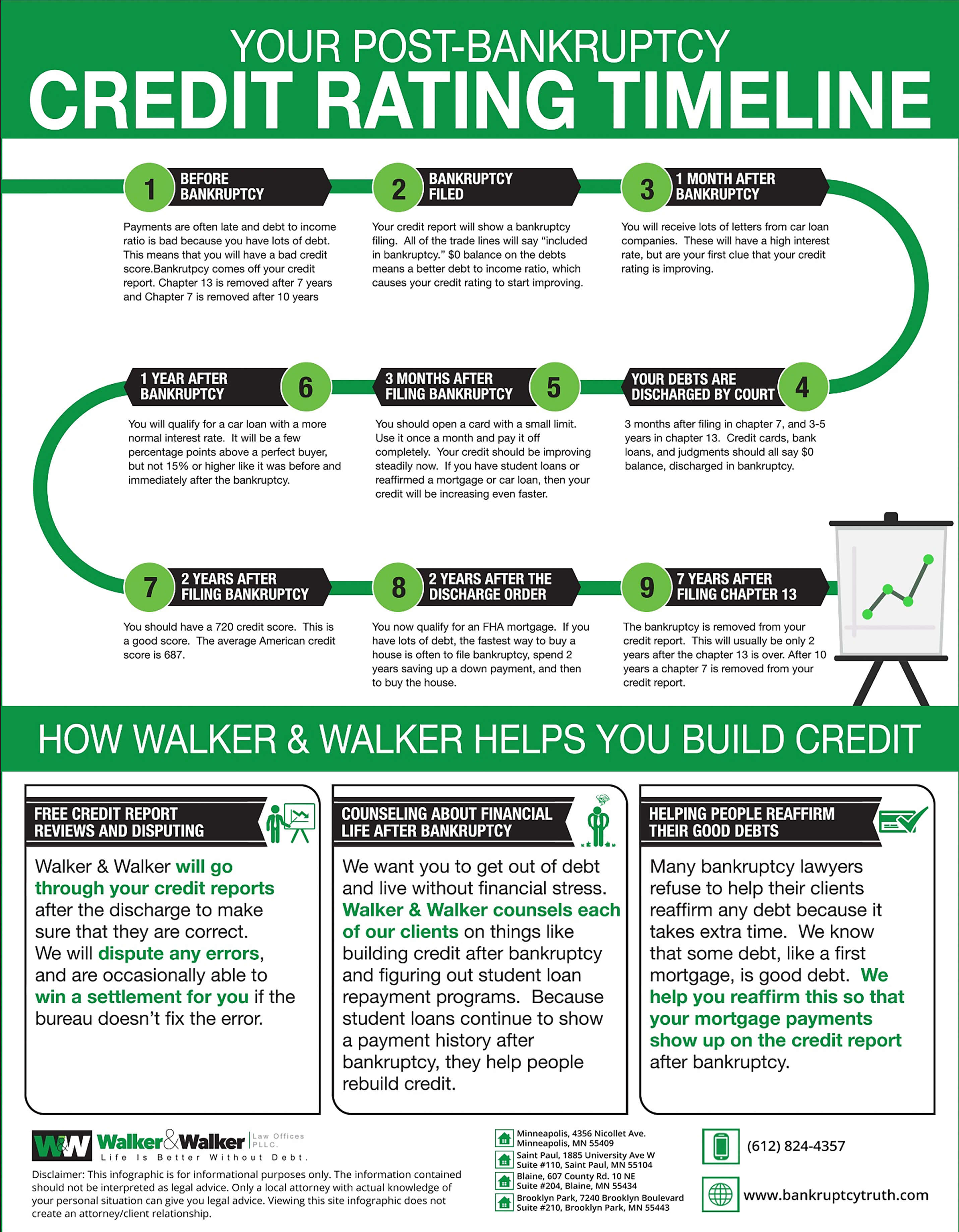

How to recover credit after bankruptcy. There are many simple things you can do to recover after bankruptcy. Consider automatic bill pay so you don’t miss due dates. By making payments on time for any remaining secured debts, your.

Credit building programs are one of the most effective methods at rebuilding credit after bankruptcy or consumer proposal. Find the right one for your unique needs. Properly applying for and using a secured credit card is one of the safest, easiest, and fastest ways to improve your.

Programs like the ones offered by refresh financial offer. Monitoring your credit following the bankruptcy process is critical. The credit limit of your card.

Although finding a lender willing to offer you a competitive product may be harder, there are still ways to get credit after bankruptcy. Practicing good financial habits is the key to building excellent credit after a bankruptcy. Find a card offer now.

7 tips for recovering 1. One of the best ways of recovering your credit after bankruptcy is to take credit builder loans. It’s a good idea to take on some reasonable credit after bankruptcy to start a positive repayment history, increase your credit variety, and show future lenders that you’re.

Ad responsible card use may help you build up fair or average credit. You’ll be asked to make a cash deposit with the credit card issuer. After you get new credit, be sure to make all your payments on time, every time.